|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding Home Equity Refinance Rates and Their Impact on Your FinancesHome equity refinance rates are a crucial factor for homeowners considering refinancing options. Understanding these rates can help you make informed financial decisions and potentially save money in the long run. What are Home Equity Refinance Rates?Home equity refinance rates refer to the interest rates applied when you refinance a mortgage using your home's equity. These rates can vary based on various factors, including market conditions, the lender, and your credit score. Factors Influencing Refinance Rates

Benefits of Refinancing Your Home EquityRefinancing can offer several advantages, such as lower interest rates, reduced monthly payments, and the opportunity to switch loan types. Lower Interest RatesSecuring a lower interest rate is a primary motivation for many homeowners. This can significantly reduce the total amount paid over the life of the loan. Comparing Loan OptionsWhen considering refinancing, it's essential to compare options. You might explore the difference between a conventional loan vs FHA loan refinance to determine which is more suitable for your situation. Steps to Refinancing Your Home Equity

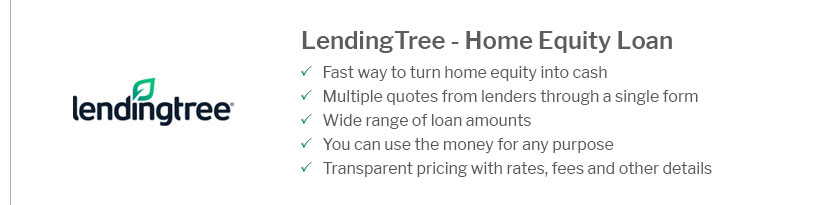

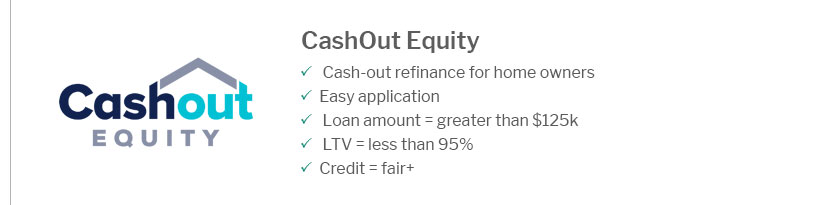

For further exploration, you might also want to consider the benefits of a cash out refinance or home equity loan to access funds. Frequently Asked Questionshttps://www.bankofamerica.com/home-equity/home-equity-rates/

Take advantage of these interest rate discounts - 0.25% - Up to 1.50% - 0.125% to 0.625% - Get more with a Bank of America Home Equity Line of Credit - What can a ... https://www.bankrate.com/home-equity/home-equity-loan-rates/

Home equity rates climbed this week, with the average rate on the 10-year, $30,000 home equity loan and the ... https://www.bankrate.com/home-equity/current-interest-rates/

22, 2025, the current home equity loan interest rate in the five of the largest U.S. markets averages 8.45 percent. MARKET, AVERAGE RATE, AVERAGE RATE RANGE ...

|

|---|